Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

If you're interested in diversifying your retirement investments beyond traditional options like stocks, bonds and funds, self-directed Solo 401(k) or self-directed IRA accounts can be valuable tools. These accounts allow individuals to invest in alternative assets such as real estate, cryptocurrency or startups.

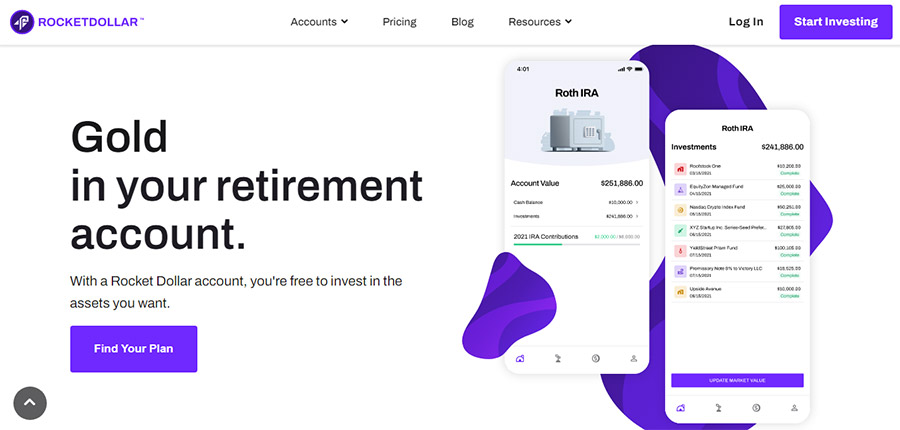

Rocket Dollar is an investment platform that facilitates self-directed IRAs, making it accessible for regular individuals to leverage these accounts. Whether you're self-employed or have a substantial IRA or rollover IRA, Rocket Dollar offers a range of self-directed options to help you take control of your retirement investments.

By opting for a self-directed account through Rocket Dollar, you can access a broader range of investment opportunities and explore asset classes that align with your investment goals. While fees may still apply, Rocket Dollar offers a competitive pricing structure to make self-directed investing more accessible to individuals.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

What Is Rocket Dollar?

Rocket Dollar is a relatively new investment platform that was founded in 2018. It aims to provide a user-friendly and cost-effective solution for self-directed investors. The platform enables individuals to invest in non-traditional assets typically unavailable through brokerage accounts.

One of the key features of Rocket Dollar is its focus on self-directed investing. Investing in alternative assets like private equity can help investors diversify their portfolios.

Peer-to-peer loans, real estate, cryptocurrencies and precious metals. This allows individuals to explore different investment avenues and achieve higher returns.

Rocket Dollar is particularly advantageous for individuals who have previously established an employer-sponsored retirement plan. It allows them to supplement their existing portfolio by investing in non-traditional assets that may not be available within their employer's plan.

The company's main office is in Austin, Texas. It is headquartered in Austin, Texas and positions itself as a platform that offers greater control and accessibility to alternative assets.

By providing a wider range of investment choices, Rocket Dollar aims to cater to the needs and preferences of self-directed investors looking for more flexibility and diversification.

Regarding funding investments, Rocket Dollar offers multiple options, including debit cards, wire transfers and check writing. This provides investors with convenient and familiar methods to manage their investment portfolios.

How Does Rocket Dollar Work?

Rocket Dollar operates by simplifying the process of opening a self-directed investment account. The account setup is conducted online, requiring users to complete the necessary sign-up process and submit the required documentation. Once the account is established, individuals can fund their investments.

A key aspect of Rocket Dollar's structure is creating a Limited Liability Company (LLC) alongside the account. The account owns the LLC and is responsible for handling the investments. All funds used for investing or received from investments are managed through the LLC's checkbook. It is crucial to maintain separation between personal funds and investment funds, ensuring compliance with regulations related to self-directed investments.

The LLC's role in managing the account's investments facilitates adherence to legal requirements. Nevertheless, it is crucial to use caution while buying and selling assets. Rocket Dollar emphasizes that engaging in "self-dealing," which involves buying or selling assets owned by oneself or one's business, is prohibited.

Additionally, Rocket Dollar assists with filing Form 5500, if necessary, as part of the ongoing services offered by the platform. This form requires certain retirement plans to report information about the plan's financial activities and ensure compliance with relevant regulations.

Rocket Dollar Features

Rocket Dollar offers several features to facilitate self-directed investing and provide a comprehensive investment experience:

Self-Directed IRA and Solo 401(k)

Rocket Dollar allows you to open a self-directed IRA or a solo 401(k) account, providing you with the flexibility to invest in a wide range of assets that the IRS does not prohibit.

Investment Tracker

Rocket Dollar provides an investment tracker feature that allows you to keep an eye on and track on performance of your assets easily. The intuitive dashboard and suite of tools offer a user-friendly experience for keeping tabs on your investments.

Assistance in Setting Up Investment Vehicles

To make investing in alternative asset classes more convenient, Rocket Dollar assists you in establishing the appropriate investment vehicle, such as an LLC or trust. This ensures compliance with regulations and facilitates the management of your investments.

LLCs for Checkbook Control Accounts

Rocket Dollar helps open them through an LLC for those seeking checkbook control accounts. You will receive the necessary legal documents, such as the operating agreement and articles of incorporation, along with an employer identification number (EIN).

This allows you to start a business bank account and invest through the LLC while maintaining control through your IRA.

Trust Accounts for Solo 401(k)

In the case of a solo 401(k), Rocket Dollar assists you in setting up a trust account. They provide the required documents, including an EIN and plan documents, to establish the trust account for your 401(k) plan.

Roth Accounts and Real Estate Investments

Rocket Dollar facilitates opening a separate account for Roth investments if desired. Additionally, you can establish an LLC within your solo 401(k) plan if you wish to invest in real estate.

Diversified Investment Options

Once you have opened a bank account through a trust or LLC, Rocket Dollar allows you to invest in various asset classes. You can invest in traditional assets like bonds, stocks, exchange-traded funds (ETFs), mutual funds and options.

The platform supports investment purchases through brokerage accounts held within your trust or LLC under your Rocket Dollar-IRA.

Rocket Dollar Pricing

Rocket Dollar operates on a transparent pricing structure that includes a flat monthly fee and an annual account setup fee:

To better understand the cost-effectiveness of Rocket Dollar's pricing, let's consider a couple of examples:

It's worth mentioning that there are no transaction fees for investments made through the trust or LLC bank account associated with your Rocket Dollar account. This means you won't incur additional charges for buying or selling assets.

You can pay the fees with your retirement fund's debit card or if you prefer not to withdraw money from your retirement fund, you can use a credit card for payment.

Membership Types

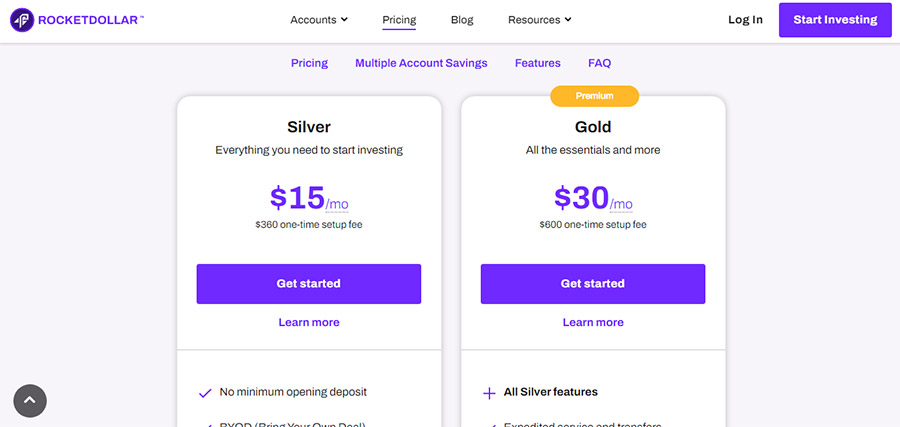

Rocket Dollar offers two membership plans: "Silver" and "Gold," each with its features and benefits.

The Silver plan requires a one-time setup fee of $360, which covers forming a limited liability company (LLC) that will be used for your investments. In addition, there is a monthly fee of $15.

With the Silver plan, you can access essential features such as the investment dashboard and investment tracker and connect with all of Rocket Dollar's investment partners.

This plan suits investors with a solid foundation for self-directed retirement accounts and alternative investments.

The Gold plan offers additional perks for investors seeking a premium experience and expedited service. In addition to the Silver plan's benefits, Gold members receive an account debit card, tax filing services and priority access to the customer support team.

The Gold plan is designed for those who value enhanced convenience, faster service and comprehensive support to make the most of their self-directed investments.

Signing Up for Rocket Dollar

Signing up for a Rocket Dollar account is a straightforward process that begins by providing your email and personal information, similar to signing up for any brokerage account.

Once you have entered your details, you can choose how to fund your account, whether through a rollover from an existing retirement account or by making a new contribution.

After selecting your preferred funding method, you can choose the products that align with your investment goals and strategy.

Rocket Dollar aims to make the onboarding process as simple as possible, ensuring that users can easily navigate through the steps. If you encounter any difficulties during the sign-up process, their customer support team can assist and address any questions or concerns.

Rocket Dollar Security

Rocket Dollar prioritizes the security of its users' accounts and has implemented robust measures to safeguard customer information. The platform holds a SOC2 (Service Organization Control 2) certification, demonstrating its commitment to maintaining the highest security standards.

The SOC2 certification involves rigorous audits conducted by independent third-party auditors. These audits evaluate Rocket Dollar's systems and processes to ensure they meet the stringent criteria set by the American Institute of Certified Public Accountants (AICPA).

The audits focus on key security principles, including privacy, confidentiality, processing integrity, availability and security.

By adhering to SOC2 standards, Rocket Dollar demonstrates its dedication to protecting user data and maintaining the integrity of its platform. The certification assures users that their sensitive information is handled and stored securely, minimizing the risk of unauthorized access or data breaches.

With the SOC2 certification in place, Rocket Dollar provides users with peace of mind, knowing that their accounts and personal information are subject to rigorous security protocols. They undergo regular audits to ensure ongoing compliance with the highest industry standards.

It's important to note that while Rocket Dollar implements robust security measures, users should also take individual precautions to protect their accounts. This includes using strong and unique passwords, enabling two-factor authentication and being vigilant against phishing attempts or suspicious activities.

Customer Service

Rocket Dollar provides various avenues for customer support to assist users with their inquiries and investment needs.

Users can contact the Rocket Dollar customer support team 24/7 through email, ensuring that assistance is available at any time. Additionally, live support via telephone is available during specific hours from 9 a.m. to 4:30 p.m. Central Standard Time (CST) on weekdays, allowing users to speak directly with a support representative.

For users who prefer traditional mail correspondence, Rocket Dollar also provides a mailing address in Austin, Texas, where they can send any physical mail or documents.

Once users have created an account with Rocket Dollar, they gain access to their client success team members via the platform's dashboard.

This direct communication channel enables users to receive personalized support and discuss their investment options directly with the team member assigned to their account.

Depending on the type of account, users can choose different support options. Silver account holders can contact support through email or schedule a phone meeting with a representative. This flexibility allows users to select the support method that best suits their preferences and needs.

With a combination of 24/7 email support, live telephone support during business hours, a client success team accessible through the platform and traditional mail options, Rocket Dollar strives to provide comprehensive customer service and ensure that users can access assistance whenever needed.

Rocket Dollar Pros

Rocket Dollar offers several advantages, making it an appealing choice for individuals interested in self-directed retirement accounts and alternative investments.

Simplified Self-Directed Retirement Accounts

Rocket Dollar takes the complexity out of managing self-directed retirement accounts. It handles the back-office documentation and administrative tasks, making it easier for users to navigate the process. This convenience saves time and effort for investors who want more control over their retirement funds.

Diverse Range of Alternative Investments

One of Rocket Dollar's biggest advantages is its access to a broad universe of investment options.

Beyond traditional stocks, bonds and mutual funds, users can explore alternative investments such as real estate, metals, commodities, cryptocurrency, equity crowdfunding, private equity lending, startup lending, conventional lending and peer-to-peer lending. This extensive selection opens up new avenues for diversification and potentially high returns.

BYOD (Bring Your Deal) Support

Rocket Dollar understands that investors may have unique investment opportunities outside their platform. With their BYOD feature, users can leverage the expertise of the Rocket Dollar team to evaluate and structure their investment deals.

This personalized support ensures that users can take advantage of any investment opportunity that aligns with their goals.

Tax Benefits

Rocket Dollar offers tax-deferred growth for investments held in self-directed retirement accounts. For Roth IRAs, the growth can even be tax-free.

This tax advantage allows investors to maximize their returns by avoiding immediate tax liabilities on their investments, potentially resulting in significant long-term savings.

Rocket Dollar Cons

Rocket Dollar has a few notable drawbacks that users should consider before opting for their services.

Limited Traditional Investments and Accounts

While Rocket Dollar excels in providing access to alternative investments, it does not offer traditional investment options like stocks, bonds, ETFs, mutual funds, options, CDs and others.

Additionally, it does not support certain account types, such as brokerage accounts, margin accounts, HSAs or custodial accounts. Investors who prefer a more conventional investment approach may find this limitation restrictive.

Higher Fees

Rocket Dollar's fees may be considered relatively high compared to some other brokers in the industry. The upfront fee of $360 ($600 for Gold) and the monthly fee of $15 ($30 for Gold) can add up over time, especially for investors with smaller portfolios.

It's essential for users to carefully evaluate the cost-benefit trade-off and ensure that the advantages offered by Rocket Dollar outweigh the higher fees.

Is Rocket Dollar a Scam?

Rocket Dollar is a legitimate business founded in 2018 and headquartered in Austin, Texas. However, it's important to note that Rocket Dollar is a relatively young company and may not have an extensive track record compared to more established financial institutions.

One aspect to consider is that Rocket Dollar is not currently registered with the Better Business Bureau (BBB) or listed by the Consumer Financial Protection Bureau (CFPB).

This lack of official recognition may raise concerns for individuals who prefer working with companies with established reputations and regulatory oversight.

When using Rocket Dollar's services, it's crucial to exercise caution and conduct thorough research. While Rocket Dollar provides a platform for self-directed retirement accounts and alternative investments, users are responsible for managing their investments and making informed decisions.

It's advisable to seek qualified financial and accounting advice from professionals outside Rocket Dollar to ensure you make well-informed investment choices.

Furthermore, it's worth noting that some investment options available through Rocket Dollar can be illiquid and volatile. This means there may be limited liquidity or potential fluctuations in the value of certain investments, which could pose risks to investors.

Conducting thorough due diligence, understanding the risks involved and diversifying your portfolio appropriately are essential steps to mitigate potential investment risks.

Final Thoughts

Rocket Dollar simplifies a previously complex problem by providing a user-friendly platform for owning alternative assets within a retirement account. While owning rental property outside a retirement account was relatively straightforward, incorporating it into a retirement account posed challenges.

Rocket Dollar has made owning real estate in a retirement account as easy as any other investment.

One of the most exciting aspects of Rocket Dollar is the ability to explore opportunities beyond traditional IRA investments. Real estate, private equity and angel investing are particularly appealing options that can be pursued with a self-directed Rocket Dollar account.

However, the platform caters to various goals and experiences, allowing users to pursue unique investment opportunities that align with their interests and objectives.

Considering the cost associated with Rocket Dollar, it is important to assess whether the benefits and potential returns of the chosen asset justify the fees involved.

If you have a solid investment in mind and can justify the cost, Rocket Dollar offers a valuable service that enables investors to think more creatively about their retirement accounts.

In summary, Rocket Dollar provides a valuable solution for individuals seeking to expand their investment options within their retirement accounts.

By simplifying the process and offering a user-friendly platform, Rocket Dollar empowers investors to pursue alternative assets and think outside the confines of traditional IRAs.

A self-directed Rocket Dollar account could be a suitable fit if you want to explore more creative and diverse investment opportunities within your retirement accounts.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<