Disclaimer: Many or all of the companies listed here may provide compensation to us. This is how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear below.

Established in 1989, Miles Franklin has built a solid reputation as a reliable and trusted source for individuals looking to buy and sell precious metals. Founded by Andrew and David Schectman, the company's main objective is to assist clients in incorporating precious metals into their investment portfolios.

Their focus extends beyond just selling bullion and numismatic items, as they strive to provide a comprehensive range of services to meet their clients' needs.

Their approach as a service provider and bargain broker sets Miles Franklin apart from traditional precious metals dealers. They aim to offer fair pricing, accurate client education and attentive customer care by operating with minimal costs. This customer-centric approach underscores their commitment to delivering quality service and ensuring client satisfaction.

Our Team Has Researched Over 100 Of The Top Precious Metals Investment Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<

With years of experience in the industry, Miles Franklin understands the importance of providing clients with accurate and up-to-date information about precious metals. They prioritize client education, helping individuals make well-informed decisions based on their investment goals and risk tolerance.

Miles Franklin's service dedication extends to their determination to establish an enduring relationship with their clients. They strive to develop trust and provide ongoing support, making themselves available to address clients' questions or concerns throughout their precious metals investing journey.

As a reputable precious metals dealer, Miles Franklin offers many products, including bullion and numismatic items, to cater to different investment preferences and strategies.

Their extensive selection allows clients to diversify their portfolios and capitalize on the benefits of owning physical precious metals.

About Miles Franklin Precious Metals

Miles Franklin was established in 1989 by David Schectman and his son Andrew, with its headquarters in Wayzata, Minnesota. Over a long time, the company has gained a strong stature for its expertise in the precious metals trade. It is a trusted source for individuals looking to buy and sell precious metals.

Miles Franklin offers various precious metals products, including coins and bars, providing customers multiple options to meet their investment needs. In addition to its bullion offerings, the company includes silver and gold IRAs, allowing clients to incorporate precious metals into their retirement savings strategies.

At the helm of Miles Franklin is Andrew Schectman, who serves as the President of Miles Franklin Ltd. With his extensive experience and dedication to client satisfaction, Andrew has played a crucial role in the company's success. He has implemented effective strategies that have resulted in over $5 billion in sales since joining the firm in 1989

Andrew Schectman takes on various responsibilities within the company, overseeing all aspects of its operations, management, strategy, planning, new business development and finances. His commitment to exceptional service and meeting clients' needs has contributed to Miles Franklin's reputation for reliability and integrity.

Meanwhile, David Schectman serves as the CEO of Miles Franklin. With a background in the precious metals sector that spans many years, David brings a wealth of knowledge and expertise to the company. He has actively participated in the industry and shared his insights by training numerous brokers on asset management and investing in precious metals.

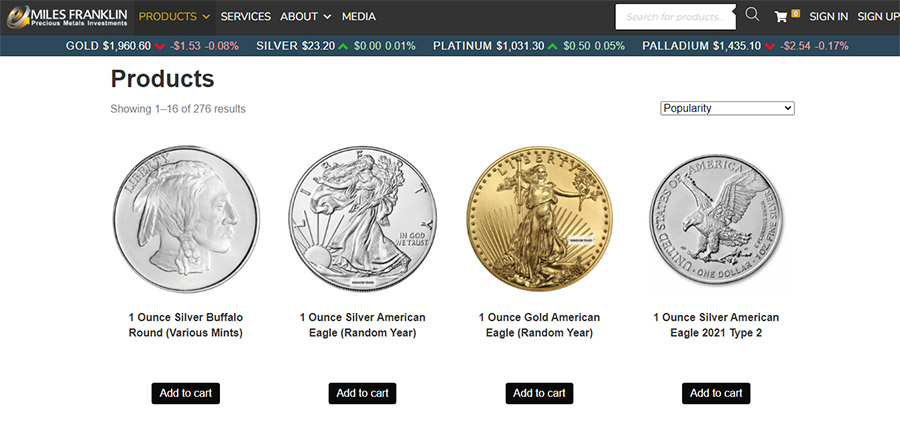

Products Offered

Miles Franklin offers an extensive range of products in precious metals, making it a comprehensive destination for investors seeking to diversify their portfolios or add tangible assets to their holdings.

The company's catalog boasts a wide selection of options, ensuring customers can find products that align with their investment goals and preferences.

For those interested in investing in gold, Miles Franklin provides gold bullion and numismatic gold coins that qualify for inclusion in IRAs.

The catalog features renowned gold coins such as the American Gold Buffalo, Australian Platinum Platypus, Canadian Gold Maple Leaf and American Gold Eagle. These coins are sought after for their inherent value, historical significance and exquisite designs.

In addition to gold, Miles Franklin offers a variety of other precious metal options. Investors can explore products such as the Canadian Palladium Maple Leaf, which appeals to those looking to diversify their portfolios with Palladium, a lesser-known but valuable precious metal.

The American Silver Eagle, a highly recognized and popular silver coin, is also available for those interested in silver investments.

Miles Franklin's commitment to providing a comprehensive selection of high-quality products ensures that investors have various options to suit their specific investment objectives.

Whether customers prefer the stability and prestige of gold, the diversification potential of Palladium or the affordability and versatility of silver, the company's product offerings cater to diverse investment preferences.

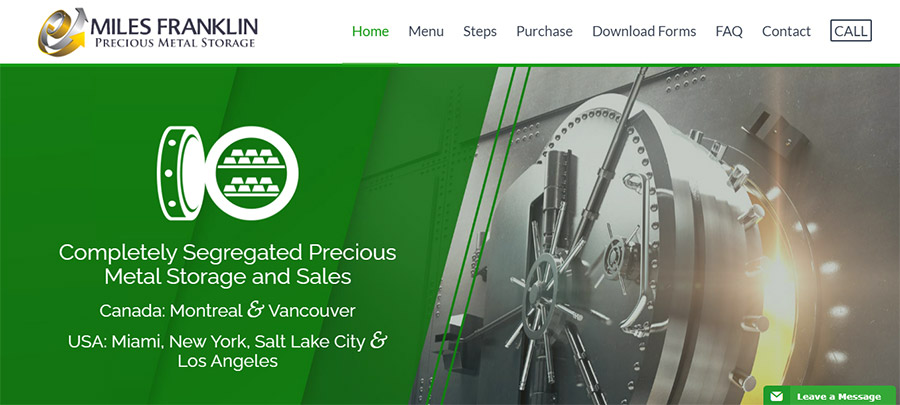

Custodian and Storage

Miles Franklin understands the paramount importance of safeguarding your precious metals purchases. For the highest level of security possible, the company utilizes two separate depositories approved by the IRS for storing precious metals.

One of the storage facilities Miles Franklin utilizes is Brinks in Montreal, Quebec. Brink's is renowned for its expertise in secure logistics and provides state-of-the-art storage solutions for your precious metals. The facility employs advanced security measures to protect stored assets and maintain integrity.

Alternatively, Miles Franklin offers you the option to store your precious metals in the company's private safe deposit box. This provides control and security for those who prefer direct access to their accumulated assets.

The private safe deposit boxes are equipped with cutting-edge bulletproof technology to ensure the safety of your gold, silver and other precious metals.

When utilizing a private safety deposit box with Miles Franklin, you can have peace of mind knowing that your valuables are securely stored in individually locked containers. Moreover, these containers are insured, providing additional protection for your precious metals.

The storage vaults are highly secure and discreet, offering heightened security for your stored assets.

By storing your purchased precious metals in a secure, fireproof safe, you have complete control and exclusive access to your accumulated assets. This ensures the utmost privacy and security, as only you have the authority to access your stored precious metals.

Opening Precious Metals IRA with Miles Franklin

If you are considering opening a precious metals IRA with Miles Franklin, you will find that the process is straightforward and well-guided. Before proceeding, it is essential to meet the eligibility requirements for a precious metals IRA.

This includes 18 years old and having an existing IRA account or another qualified retirement account such as a 401(k) or 403(b). Additionally, you should be financially capable of making the minimum purchase of eligible precious metals.

The initial stage is to contact the company to start setting up a precious metals IRA with Miles Franklin. By reaching out to Miles Franklin, you can engage in a detailed discussion about your specific requirements and preferences.

A knowledgeable agent from Miles Franklin will provide comprehensive information on the types of gold, silver and platinum coins and bars they offer. They will also explain the process of opening an IRA and provide details on associated fees.

Once you decide to proceed with Miles Franklin as your precious metals IRA custodian, the next step is establishing an IRA account with them. You will receive the necessary paperwork from Miles Franklin, which will require you to provide your details, for instance, your name, address, Social Security Number and other pertinent financial information.

After successfully setting up your IRA account, you can transfer funds from your current IRA or other eligible investments into your new Miles Franklin IRA account. The company will provide clear instructions on facilitating the smooth transfer of funds into your precious metals IRA.

With funds now available in your IRA account, you can buy gold, silver and platinum coins and bars from Miles Franklin. Their knowledgeable team will assist you in making informed decisions about the items that best suit your investment goals.

They will provide detailed information on the various types of coins and bars available, as well as the current market value of each item.

Once you have made your purchases, Miles Franklin will ensure the secure storage of your precious metals. They offer reliable and safe storage options, providing peace of mind knowing that your valuable coins and bars are well-protected.

Miles Franklin will provide comprehensive instructions on storing your precious metals safely, ensuring their physical integrity and security.

Pros and Cons of Miles Franklin Precious Metals

Pros

Cons

IRA Account Types

Several types of IRA accounts are available, each with its rules and benefits. Comprehending these different types can help you choose the best suits your financial goals and circumstances.

#1. Traditional IRA

A traditional IRA is a popular choice for many individuals. It allows you to contribute pre-tax income, reducing your taxable income in the contribution year.

The funds in a traditional IRA grow tax-deferred, meaning you won't pay taxes on them until you withdraw during retirement.

The tax deducted from Your contributions may depend on your income, filing status and whether you or your spouse have a workplace retirement plan. The contribution limit for a traditional IRA is $6,000 per year, with an additional $1,000 catch-up contribution allowed for individuals aged 50 and older.

#2. Roth IRA

A Roth IRA is another type of individual retirement account. Unlike a traditional IRA, contributions to a Roth IRA are made with after-tax dollars, so you don't get an immediate tax deduction. However, a Roth IRA's advantage is that qualified retirement withdrawals are tax-free. This includes both contributions and earnings.

Roth IRAs also offer more flexibility in leaves, as you can withdraw your contributions (not earnings) without penalty. The contribution limits for a Roth IRA are similar to a traditional IRA.

#3. SEP IRA

A Simplified Employee Pension (SEP) IRA is a retirement plan for self-employed individuals and small business owners. Employers can make tax-deductible contributions to SEP IRAs on behalf of their employees.

The contribution limit for a SEP IRA is up to 25% of an employee's compensation or $66,000 (whichever is less) for 2021. The funds in a SEP IRA grow tax-deferred until withdrawn during retirement.

#4. SIMPLE IRA

A Savings Incentive Match Plan for Employees (SIMPLE) IRA is designed for small businesses with 100 or fewer employees. It offers an affordable and easy-to-administer retirement plan. Both employers and employees can contribute to a SIMPLE IRA.

Employees can contribute up to $13,500 in 2021, with an additional catch-up contribution of $3,000 allowed for individuals aged 50 and older. Employers can choose to make matching or non-elective contributions for their employees.

What Precious Metals Are IRA-Eligible?

Certain types of precious metals are eligible to be held in an IRA. These include gold, silver, platinum and Palladium. These metals are considered "collectible" investments rather than securities, allowing investors to diversify their retirement portfolio with tangible assets.

Gold is the most popular choice among IRA investors. For a long time, it has been recognized as a reliable store of value and has been used as a currency for centuries.

Gold's stability and global recognition make it an attractive option for those seeking to preserve their wealth over the long term.

Silver is another commonly chosen precious metal for IRAs. It is more affordable than gold, making it accessible to a broader range of investors. Like gold, silver has a history of being used as currency and is often seen as a hedge against economic uncertainty.

Platinum, while less popular than gold and silver, is also eligible for inclusion in an IRA. It is a rare metal with a higher intrinsic value than gold or silver. Platinum's industrial uses and limited supply contribute to its appeal as a long-term investment.

Although less widely accepted as an IRA-eligible metal, Palladium can still be included in an IRA for diversification purposes. It has gained attention in recent years due to its rise in demand in the automotive industry and limited supply.

Investors looking for alternative precious metals may consider palladium part of their IRA holdings.

These precious metals must meet specific purity requirements to be eligible for an IRA Gold must have a minimum purity of 99.5%, silver must have a minimum purity of 99.9% and platinum and Palladium must have a minimum purity of 99.95%.

It is crucial to ensure that the precious metals meet these purity standards to comply with IRS regulations.

Why Precious Metals IRA Is a Worthwhile Investment

Precious Metals IRA investment can be a highly beneficial and worthwhile strategy for several compelling reasons:

Choosing the Right Precious Metals Dealer

When selecting a precious metals dealer, it is crucial to carefully consider several factors to ensure a successful and trustworthy transaction.

❑ Reputation and Track Record

Thoroughly research the dealer's reputation and track record. Check online reviews, testimonials and ratings from reputable sources. Look for complaints or negative feedback that may raise concerns about their reliability or integrity.

Contacting the Better Business Bureau can provide additional insights into the dealer's standing and any unresolved issues.

❑ Recommendations and Referrals

Seek recommendations from people you believe in, such as friends, family or fellow investors who have had positive experiences with precious metals dealers. Their firsthand experiences can offer valuable insights and help you make an informed decision.

❑ Customer Service

Evaluate the dealer's customer service and support. It is crucial to reach a knowledgeable and committed customer service team that can address your questions, provide guidance and offer assistance throughout the buying or selling process.

❑ Payment Methods and Speed

Consider the dealer's available payment methods and assess their convenience and security. Popular options include bank transfers, checks, wire transfers and cryptocurrency. Additionally, inquire about the expected payment speed to ensure timely and efficient transactions.

❑ Selection and Pricing

Ensure that the dealer offers a wide selection of precious metals, including gold, silver, platinum and Palladium, with various denominations and forms, such as coins and bars.

Assess and compare their pricing structure with market rates to ensure fair and competitive pricing. Be wary of dealers that charge hidden fees or commissions that may diminish the overall value of your investment.

❑ Licensing and Accreditation

Verify whether the dealer is licensed and registered with relevant regulatory bodies such as the National Futures Association (NFA) or other reputable organizations. This ensures the dealer operates within industry standards and follows strict guidelines for fair and transparent transactions.

❑ Insurance and Secure Storage

Inquire about the dealer's insurance coverage and storage options for your precious metals. A reputable dealer should provide secure storage solutions that protect your investment from loss, theft or damage. Understanding the storage facilities and security measures can offer peace of mind.

Final Thoughts

Miles Franklin is an established and reputable precious metals dealer with nearly 30 years of experience in the industry. They offer a variety of precious metals, support IRA eligibility, provide secure storage options and strive for transparent pricing.

However, while Miles Franklin has a positive track record, it is crucial to consider individual preferences and investment goals when selecting a precious metals dealer.

Other companies in the market may offer a more comprehensive selection, better service and more competitive prices.

Don't Forget To Checkout Our Highest Recommended Companies

Before you are making an investment, make sure that you are choosing a trusted company to help you with your investment.

>> See Our Top 5 Precious Metals Investment Companies Here <<